Table of Contents

Good year for investment

Business reputations

Property as an investment

Revival in maquiladora industry

Power projects

Walmart strides forward

Low tech solution to city water woes

DaimlerChrysler buses

The housing boom – a special report

More mortgages

Low-income homes

Luxury homes

Single personal identity code?

Tequila week

Train to the airport?

Mail boxes etc

Popeye in Mexico

Good year for investment

According to Héctor Rangel Domene, the president of the Business Coordination Council (Consejo Coordinador Empresarial, CCE), this should be a good year for economic growth and investment. The CCE estimates that 350,000 new jobs will be generated this year.

Analysts surveyed by the central bank, Bank of Mexico (Banxico), predicted that GDP would grow 3.23% this year, with inflation of about 4%. The Finance Secretary Francisco Gil Díaz is confident that the economy is growing at more than 3% a year.

A Federal Program to boost business competitiveness 2004-2006 was announced recently. Among the areas that it stresses are a reduction in logistics costs, streamlined regulations and the provision of a greater variety of energy sources.

James Callahan, the president and CEO of the American Chamber of Commerce in Mexico (AmCham) thinks the economy could grow by as much as 6.0% a year if structural reforms are enacted and relatively high energy costs brought under control.

The National Statistics Institute (INEGI) reports a continued rise in consumer confidence and a dramatic up-turn in the number of people considering making purchases of durable consumer goods, such as furniture, televisions and washing machines. INEGI’s “Purchase Expectations” Index rose from 79.0 points in March 2003 to 93.9 points in March this year.

Business reputations

Consulta Mitofsky and Transparencia Mexicana have issued a report with details of the 2004 Mexican Index of Business Reputation (Índice Mexicano de Reputación Empresarial 2004, IMRE). This new index of business quality takes several characteristics into account including shareholder, investor and partner satisfaction, respect for regulations and norms, customer service, environmental policies, workers’ rights and community relations.

According to the 2004 IMRE, the companies with the best reputations in Mexico are Grupo Industrial Bimbo (bread-maker), the Instituto Tecnológico y de Estudios Superiores de Monterrey, and Cemex. Also high on the list were Grupo Modelo, Instituto Tecnológico Autónomo de México (ITAM), the University of the Americas (Universidad de las Américas) in Puebla, Vitro, Coca Cola FEMSA and Cervecería Cuauhtémoc Moctezuma.

Revival in maquiladora industry

According to the National Statistics Agency (Instituto Nacional de Estadística, Geografía e Informática) INEGI, the number of in-bond maquiladora plants, producing for export markets, has risen steadily during the past few months. At the end of January, there were 2,805 registered maquiladoras.

The upswing follows almost two years of contraction and is another encouraging sign that the economy is poised for rapid growth, and ready to help supply consumers in the reviving U.S. economy. As of January, more than 1.06 million jobs were provided by maquiladora firms.

Power projects

The Federal Electricity Commission (Comisión Federal de Electricidad, CFE) is promoting the construction of 21 major power generation projects, requiring a total investment of 6.5 billion dollars, as part of its 10 year development plan.

During 2004, 4 generating stations are scheduled to come on line: Guerrero Negro II, Baja California I, Río Bravo III, and the second phase of the Manuel Moreno Torres hydro-power station in Chiapas.

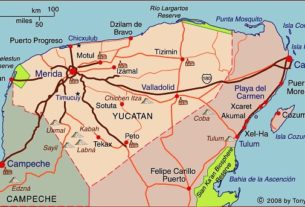

Ten other projects are currently under construction, including Altamira V (1,121 megawatts), El Cajón (750 megawatts) and Valladolid III (525 megawatts). New plants still being planned include Tamazunchale (1,000 megawatts) in San Luis Potosí, La Venta II, a wind-power station in the state of Oaxaca, and Agua Prieta II in Sonora.

Property as an investment

The national real estate firm Grupo Acción has completed the sale of 56 industrial and office properties in 11 cities across Mexico to the State of California Public Employees Retirement System (Sistema de Retiro de Empleados Públicos del Estado de California) and LaSalle Investment, for 296 million dollars.

The buildings total more than 500,000 square meters in area and generate 30 million dollars in annual operating revenue. Acción, which sold a 41% stake in its operations to Peabody in 1999, has agreements in place with Kimco Realty for building shopping centers and AMB for developing distribution centers.

Walmart strides forward

Latin America’s biggest retailer, WalMart de México (Walmex), has begun its latest 18-month plan, by investing more than 109 million dollars (1.224 billion pesos) during the first few months of this year to add 25 new stores and restaurants to its chains. The additional units will boost the company’s total installed capacity by 12%.

The company’s first-quarter net profits jumped 33%, compared with a year earlier, to 118 million dollars (1.312 billion pesos), on improved revenues and lower costs. Company plans call for further investments by mid-2005 to add 77 more stores to its network. Walmex operates 642 stores and restaurants, providing some 100,000 jobs.

Low tech solution to city water woes

Ironically, for a city founded on an island in the middle of a lake, Mexico City suffers from numerous water-related problems.

On the one hand, it has problems providing sufficient potable water for its 16 million or so inhabitants. Extraction from local wells, for domestic and industrial use, has caused the underlying sediments to dry out and shrink, disturbing the foundations of historic buildings and lowering the surface in parts of the city by up to 15 centimeters a year. Drinking water has to be brought hundreds of kilometers to meet the city’s needs.

On the other hand, during the summer rainy season, Mexico City has difficulties disposing of excess rainwater and preventing flooding.

After centuries of attempts at resolving these problems by completing expensive infrastructure projects, a low tech alternative is now being tried. Work has begun on making 600 absorption wells in the Tlalpan, Milpa Alta, Xochimilco, Magdalena Contreras and Cuajimalpa districts of the city. They will collect rainwater and funnel it underground to replenish the subterranean aquifers.

This should reduce the risks of flooding, diminish the rate of shrinkage, limit future damage to foundations, and eventually restore some of the aquifers to full health. Over the next 3 years, 1400 more absorption wells will be built, at an average cost of 9,000 dollars (100,000 pesos) each.

DaimlerChrysler buses

More than 27,000 professionals visited Expo Foro 2004, Mexico’s most important exhibition of passenger transport vehicles, organized each year by the Cámara Nacional de Pasajeros y Turismo (Canapat). DaimlerChrysler is Mexico’s leading manufacturer of passenger buses and the country is the firm’s third largest market worldwide. Of the 9,000 buses sold in Mexico each year, almost half are Mercedes-Benz vehicles.

DaimlerChrysler announced that it is in the process of investing 100 million dollars in expanding its two major manufacturing plants, in Santiago Tianguistenco, near Mexico City, and García (in the state of Nuevo León). DaimlerChrysler has also announced investments of 45 million dollars to expand its Toluca auto plant to make all versions of the PT convertible for export.

The housing boom – a special report

More mortgages

Construction companies are expected to do well over the next 18 months as demand for single family homes escalates and more home loans become available, including many from government housing agencies. According to Carlos Gutiérrez Ruiz, the head of the National Housing Development Commission (Conafovi), 700,000 new houses are needed this year, with 720,000 more in 2005. Conafovi’s projections call for the construction of 5.16 million new homes by 2010.

Mortgage rates available from banks have fallen sharply with at least one major bank now offering rates as low as 9.9%, the lowest rate for many years.

Financing of low-income housing is dominated by government-run Infonavit. Infonavit has provided 1.8 million mortgages in the past three years, and intends to increase its mortgage business by 11.1% a year over the next five years. This would turn Infonavit into one of the largest housing lenders in North America.

Infonavit has begun raising funds by offering mortgage-backed securities on a quarterly basis. The first issues, rated AAA by ratings agencies, were heavily oversubscribed, with a particularly strong demand from insurance and pension funds.

Low-income homes

Geo, Mexico’s largest home construction company, is predicting growth of 14% this year. During 2003, it sold 29,520 homes, an increase of 8.9% over 2002. Another leading home builder, Consorcio Ara, is investing 140 million dollars (1.549 billion pesos) to build 6,704 low and middle income homes in its “Real del Valle” development in the municipality of Acolman in the state of México. More than 30,000 jobs will be created during the construction phase.

Ara (2003 sales: 430 million dollars) has built more than 100,000 homes over the past 25 years.

Luxury homes

At the other end of the income spectrum, the projected 10,000 homes in Bosque Real, a luxury development on 600 hectares in Huixquilucan, near Naucalpan in the state of México, will become Mexico’s first major wireless broadband community.

The U.S. firm Acelera is equipping every home with wireless (Wi-Fi) terminals for digital Internet, telephone and video, at transmission speeds of up to 500 megabytes a second. The planners of Bosque Real believe that the Wi-Fi set-up costs are more than offset by the savings resulting from not having to lay cables everywhere.

They envisage that Bosque Real will gradually evolve into an independent mini-city, complete with its own offices, schools, stores and recreational areas.

Another alternative for luxury living is the Santa Fe area in Mexico City, where apartment prices are now significantly higher (on a per square meter basis) than they are in Miami. The current real estate listings for Santa Fe include apartments (some still under construction) ranging from 450,000 to two million dollars.

Single personal identity code?

In a further move towards simplifying regulation, the Tax authorities (Servicio de Administración Tributaria, SAT) are working with State governments to unify personal identification “codes” such as the Registro Federal de Contribuyentes (RFC), the Unique Population Register Code (Clave Única de Registro de población) (CURP) and professional title ID numbers (cédula profesional). They hope to create a common platform for all new registrations, linking municipal, state and federal authorities, before the end of the year.

Tequila week

This month, participants from 30 countries will be attending the International Tequila Week in Guadalajara to celebrate the 10th anniversary of the Tequila Regulatory Council (Consejo Regulador del Tequila (CRT). The festival, running from May 17-21 includes art exhibits, book presentations and lectures. CRT’s CEO, Ramón González Figueroa, says there are currently 106 plants making 739 brands of tequila for sale in 120 countries.

Train to the airport?

A group of Jalisco business leaders have presented a plan to build a 30-kilometer-long monorail or light train system running along a linear park between Guadalajara and its international airport.

The line would provide a link to the city’s existing light train network and have one end at the existing railroad station in downtown Guadalajara, where a shopping mall, amusement park and movie theater would be built.

A feasibility study is reported to be under way and construction may start as early as this year. Financing for the project has apparently been promised from investors in Mexico, the U.S. and the Middle East.

Mail boxes etc

Mail Boxes Etc. (MBE), owned by UPS, has announced a new round of licenses in Mexico to add 300 new outlets to its existing chain over the next 10 years. MBE provides “all-in-one” business solutions for packaging, shipping, mail boxes, copies, fund transfers and sales of office supplies and packing materials.

To help ensure success, MBE is setting up a new center offering all regular services that will act as a training school for franchise purchasers. The cost for an MBE franchise ranges from 120,000 to 180,000 dollars.

Popeye in Mexico

Popeye Chicken is the second largest fast food chain specializing in chicken in the world, with 1803 outlets at the end of last year. A firm in Monterrey holds the rights to use the Popeye name in the northern border states of Nuevo León, Tamaulipas, Coahuila and Chihuahua. Now, Alsea, one of Mexico’s leading franchise operators, is buying the master franchise rights for the remainder of the country, aiming to open 110 Popeye outlets in 9 years.

Chicken comprises about 24% of fast food sales in Mexico, where the average consumption of chicken per capita is estimated at 20 kilos a year. Alsea operates numerous franchises in the country, including Starbucks Coffee, Burger King and Domino’s Pizza.

The text of this report was not submitted to any Federal Mexican Authorities or approved by them prior to publication. In preparing it, we have done our own research, using sources we believe to be reliable. However, we do not guarantee its accuracy. Neither the information contained herein nor the opinions expressed, constitute a solicitation by us of the purchase of any security.